Table Of Content

A local insurance agent might be happy to give you an idea about prices in the area since you could become a future client. If you just want to ballpark it, the national average annual premium for a $250,000 home is about $1,100 (about $92/month). Let’s go over some of the inputs to our home affordability calculator, plus some extra factors you’ll want to consider. But if you can swing a balance transfer it might be able to help you fast-track your debt payment and get you to the debt-to-income ratio you need to qualify for a home purchase.

Today's mortgage and refinance rates

Most importantly, it takes into account all of your monthly obligations to determine if a home could be comfortably within financial reach. Down payment & closing costsNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features. For homeowners looking to leverage their home's value to cover a big purchase — such as a home renovation — a home equity line of credit (HELOC) may be a good option while we wait for mortgage rates to ease. Check out some of our best HELOC lenders to start your search for the right loan for you. A loan is money that is borrowed by one person or company from another, under an agreement whereby the borrower promises to re-pay the loan amount to the lender, usually plus interest.

Learn About Mortgages

Mortgage rates will likely remain elevated until inflation slows further and the Fed is able to start lowering the federal funds rate. Investors are currently pricing in September for the first Fed cut, according to the CME FedWatch Tool. This means we could see mortgage rates start to trend down in fall.

Property Taxes

Amy Fontinelle is a freelance writer, researcher and editor who brings a journalistic approach to personal finance content. Since 2004, she has worked with lenders, real estate agents, consultants, financial advisors, family offices, wealth managers, insurance companies, payment companies and leading personal finance websites. Amy also has extensive experience editing academic papers and articles by professional economists, including eight years as the production manager of an economics journal. Once again, the answer to this question will depend on where you want to buy and what kind of property you want. Your credit score and DTI will also be important factors in determining what interest rate and loan terms you get from the lender. Once you can put down 20%, you won’t have to pay for mortgage insurance.

Mortgage Calculator: Estimate Your Monthly Payments - Business Insider

Mortgage Calculator: Estimate Your Monthly Payments.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years. This is another common mortgage term that allows the borrower to save money by paying less total interest. However, monthly payments are higher on 15-year mortgages than 30-year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers. Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to see that when you add up your principal, interest, taxes and insurance, it totals less than 28% of your gross monthly income. Lenders also generally want to see that those housing costs plus other debt (i.e. auto loans) are less than 36% of your gross monthly income.

VA loan (government loan)

They will also decrease how much interest you pay on those debts. But, think of it this way, you’ll improve your chances for a favorable mortgage, which is usually 30 years of your life. Waiting a few years to put yourself in a better position is just a fraction of time compared to the many years you’ll spend paying your monthly mortgage bill. Adjustable-rate mortgages (ARMs) have interest rates that can change over time.

When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government. Loan limits change annually and are specific to the local market. Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing. Equally, the lower the interest rate you can get the less you’ll pay each month against your mortgage as well as over the life of the loan.

However, this loan typically requires private mortgage insurance (PMI) which should be added into your monthly expenditures. PMI is usually .05-1% of the cost of the home loan but may vary depending on credit score. An FHA loan is a mortgage insured by the Federal Housing Administration. Borrowers must pay for mortgage insurance in order to protect lenders from losses in instances of defaults on loans. The insurance allows lenders to offer FHA loans at lower interest rates than usual with more flexible requirements, such as lower down payment as a percentage of the purchase price.

Mortgage Calculator: How Much Can I Borrow? - NerdWallet

Mortgage Calculator: How Much Can I Borrow?.

Posted: Mon, 26 Feb 2024 08:00:00 GMT [source]

Two benefits to this mortgage loan type are stability and being able to calculate your total interest on your home upfront. As you think about your mortgage payments, it’s important to understand the difference between what you can spend versus what you can spend while still living comfortably and limiting your financial stress. For example, let’s say that you could technically afford to spend $4,000 each month on a mortgage payment. If you only have $500 remaining after covering your other expenses, you’re likely stretching yourself too thin. Remember that there are other major financial goals to consider, too, and you want to live within your means.

The Veterans Affairs Department (VA) is an agency of the U.S. government. VA loans make home ownership more possible for borrowers than it otherwise would be through conventional mortgage loans, primarily because a VA loan does not require any down payment. Additionally, interest rates offered for VA loans often turn out to be lower than those offered for conventional loans. What if you have a student loan in deferment or forbearance and you’re not making payments right now?

Some features of the online application are not available with all loans; talk to a home mortgage consultant. You’ll often hear that you should have three to six months’ worth of living expenses saved to cover emergencies. As a homeowner, you’d be wise to have six months to two years’ worth of living expenses saved. You never know when a global pandemic might wreak havoc on your ability to earn a living and pay for your home. While maintaining a debt-to-income ratio under 36% protects you from minor changes in your finances, a cash reserve protects against major ones.

And from applying for a loan to managing your mortgage, Chase MyHome has everything you need. Take stock of your finances to see if you’re ready to apply for a mortgage. Make sure that you can provide evidence of at least two years’ worth of regular income, and figure out your total assets, debt and monthly expenses. Add up your debt obligations such as car loans, credit cards, personal loans or other mortgages and enter the total. A report made by a qualified person to estimate the value of a property, often used to help determine an appropriate loan limit. If you're purchasing, the appraised value usually needs to be equal to or greater than the home's purchase price.

Read more on specialized loans, such as VA loan requirements and FHA loan qualification. In addition, take a look at the best places to get a mortgage in the U.S. You can also check out current mortgage rates in your area for an idea of what the market looks like. In the case of a 30-year mortgage (depending, of course, on the interest rate) the loan’s interest can add up to three or four times the listed price of the house (yes, you read that right!).

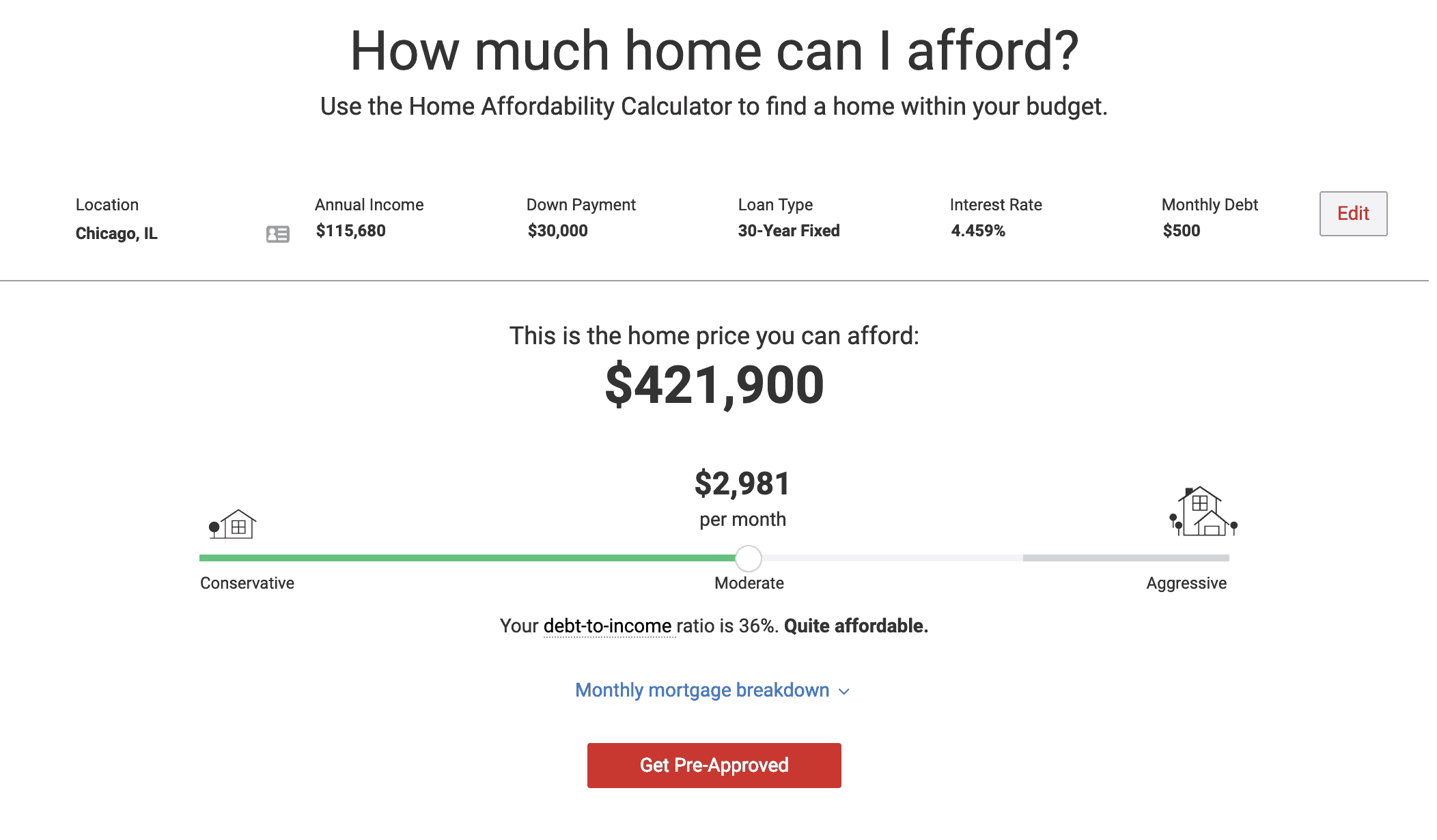

Use the home affordability calculator to help you estimate how much home you can afford. Understanding the difference — and then using a home affordability calculator to crunch some numbers — will help you decide how much house you can really afford. Here are a few documents you should gather to help you understand your financial situation and how much house you can afford. This information will also be required when you apply for a pre-approved home loan. List out your expenses and then add them together to get your total monthly spending.

Although it’s possible to find lenders willing to do so (but often at higher interest rates), the thinking behind the rule is instructive. Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages.

The down payment is an essential component of home affordability. Bankrate’s mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And don’t forget to think about the potential for mortgage insurance premiums to impact your budget. If you make a down payment of less than 20 percent on a conventional loan, you’ll need to pay for private mortgage insurance, or PMI. When determining what home price you can afford, a guideline that’s useful to follow is the 36% rule. For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes.

No comments:

Post a Comment